The Nation magazine this morning published my essay, A Bitcoin Mining Exposé Strengthens the Case for a Carbon Tax. I’ve cross-posted it here to allow comments and add tables and graphics.

— C.K., April 20, 2023

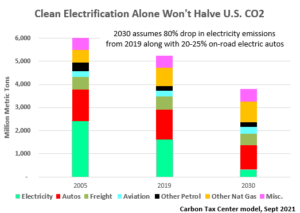

Clean electricity, the backbone of the Biden administration’s strategy for slashing carbon emissions, is becoming daunting to expand.

US wind farms, which last year generated more electricity than all hydropower and solar panels in the 50 states combined, often face years of contention. The entire mid-Atlantic offshore region, an area brimming with wind potential, could be proscribed by Pentagon fretting over interferences with aircraft deployment, Bloomberg News disclosed this week.

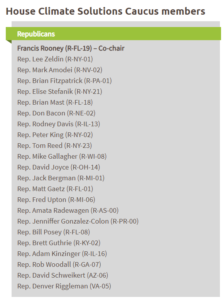

But if red tape for green power is a bother, why not get the benefits with none of the fuss? Send commando teams to the 34 large-scale Bitcoin mining sites in the United States that were identified in a New York Times front-page exposé this month. In synchrony, have them sever the facilities’ power cables, which combined demand some 3,900 megawatts of electricity—nearly as much as 3 million households combined.

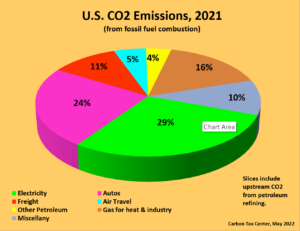

In a flash, legions of electricity-gulping, combination-seeking computers in Texas, New York, and 13 other states would cease whirring. Like a power surge but in reverse, the fossil-fuel generators energizing so-called cryptocurrency mining—literally, trillions of combination-seeking calculations every second—would dial down. The corresponding drop in carbon emissions would be the same as if thousands of new industrial-size wind turbines could be instantly erected and connected to grids, supplanting electricity now furnished by burning coal and methane gas.

Data adapted from NY Times April 9, 2023 story. Link in text above. FF% is estimated percent of *incremental* power demand supplied from coal or methane gas.

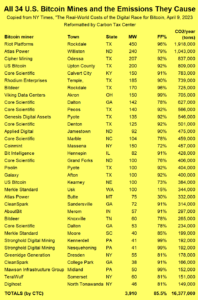

Fanciful? Consider the numbers. The Times helpfully enumerated each Bitcoin mine’s fossil-fueled draw on state and regional power grids along with the associated carbon emissions. It took only a few further steps for me to translate those emissions into generic megawatts of clean power that would defray them. Using today’s customary 300-foot-tall, 3.6-megawatt wind machines as my standard, I calculated a staggering 3,700 turbines.

There you have it: The US Bitcoin industry is single-handedly neutering the entire climate benefit from nearly 10 percent of US wind energy. That’s more electricity than is generated with wind in any single state, save Texas and Iowa.

This raises two uncomfortable questions for the climate movement: Why isn’t it rallying against Bitcoin mines and other parasitic users of carbon fuels? And why isn’t it taking the obvious step of calling for a tax on carbon emissions to reduce those usages while simultaneously extracting revenues from them?

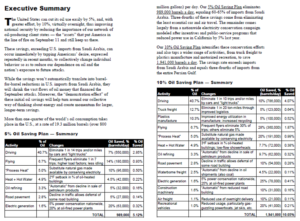

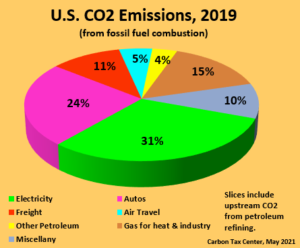

Second question first. Generating the electricity consumed by those 34 Bitcoin mines causes 16.4 million tons of carbon dioxide emissions each year, according to the Times. If the United States had a $100 per ton carbon tax—the current price of carbon emission permits in the European Union’s cap-and-trade system—the carbon levies at the mine mouth and wellhead would be extracting $1.5 billion a year from the fossil fuel companies that power the Bitcoin operations, and depositing it into the Treasury.

To be sure, that money would only fund a mere 2.4 hours of federal spending a year—barely a single baseball game’s worth, under the new hurry-up-and-pitch rules. On the other hand, the tax moneys are twice what Fox News will pay Dominion Voting Systems under the settlement reached this week. And they’re recurring.

But it would not be extinguished. That’s where the climate movement comes in.

But it would not be extinguished. That’s where the climate movement comes in.

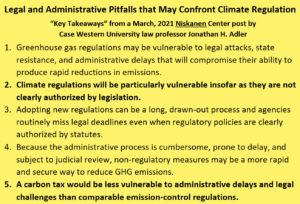

Had the tax been in place a decade ago, as I and others urged, the extra expense might have stopped some cyber-currency ventures from the git-go. But if it were put into place today, a robust carbon tax could at least impel Bitcoin miners to economize on electricity, charge more for transactions, or actually contract with greener power providers rather than merely pretending to, as the Times found.

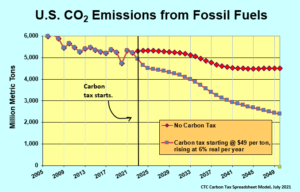

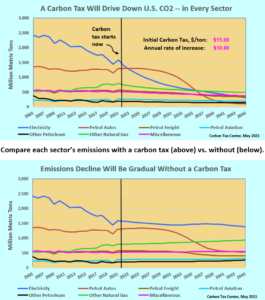

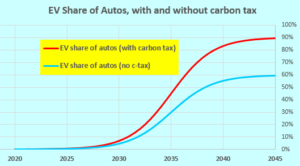

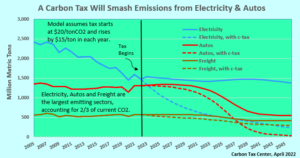

Although no one can pinpoint precisely how a carbon tax would shrink Bitcoin mining’s carbon footprint, let alone any single sector’s, abundant empirical evidence suggests that total US carbon emissions would be around a third less with a triple-digit national carbon tax than without. Bitcoin would not be exempt.

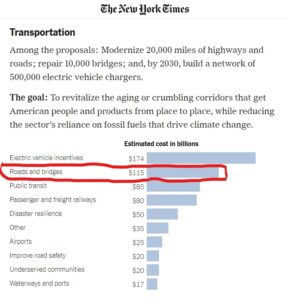

The movement has targeted banks and pipelines for more than a decade, with not much to show in the way of lesser carbon emissions. Why isn’t it disrupting Bitcoin mining and other bloodsucking machines—helicopters, private jets, yachts, super-sized SUVs—that feed on fossil fuels and are predominantly playthings of plutocrats? Why isn’t it going all out to stop highway expansions and eliminate restrictive zoning that lock in energy waste for generations?

Yes, climate activists stopped Keystone XL. They won a ban on fracking in New York. They’re fighting to drive oil drilling out of Los Angeles. Valiant, heroic work. But these and other keep-it-in-the-ground victories are creating little climate benefit. Why? Because the same underlying demand, largely unaffected by those protests, is met by supplies from elsewhere.

The bank protests seem even less focused. Conoco doesn’t need financing from JPMorgan Chase or Wells Fargo to drill in the National Petroleum Reserve in Alaska. The only “bank” it requires is the collective fuel tanks of America’s 280 million motor vehicles, plus aircraft, off-road vehicles, and pleasure boats.

The bank protests seem even less focused. Conoco doesn’t need financing from JPMorgan Chase or Wells Fargo to drill in the National Petroleum Reserve in Alaska. The only “bank” it requires is the collective fuel tanks of America’s 280 million motor vehicles, plus aircraft, off-road vehicles, and pleasure boats.

Marching on Citibank does send a message, and activating seniors who might otherwise sit at home posting about their grandkids is soul-stirring. But if divestment and bank-shaming were going to slow the assault on climate, we would have seen bigger results by now.

“If the world wants to limit warming,” Norwegian energy researcher Espen Erlingsen told the Times this month, “it will have to limit demand for oil and gas because [the] industry can deliver this kind of volume for many more decades.”

Amen. The climate movement’s strategy isn’t working. Trying to bottle up supply instead of throttling demand is whack-a-mole without end, chasing after but never stopping capitalism’s dynamism from erupting in crypto mining and 1,001 other climate-destroying products and technologies.

By itself, a carbon tax won’t cure that. But it would at least start to steer innovation and cultural norms away from endless new climate horrors.

As Philip Roth’s Mickey Sabbath might have said: Either tax carbon or bring on the commandos.

Addendum: My concluding sentence — perhaps too subtle a literary reference — is elucidated in Brian A. Oard’s delightful Mindful Pleasures website. Please note that the ultimatum was uttered not by Sabbath but by his lover, Drenka. — C.K.

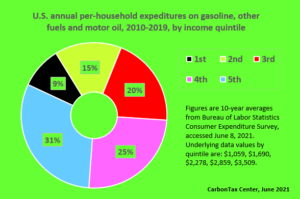

The supposed impossibility of reducing the use of gasoline by raising its price has been part and parcel of Big Green’s attachment to mpg standards — despite the fact that mileage reg’s do nothing to reduce driving and its vast negative consequences: not just traffic congestion but also poor health (sedentary living, car crashes, noise) and general unaffordability (car loan costs, upkeep expenses, costlier housing due to cars’ consuming urban and suburban land).

The supposed impossibility of reducing the use of gasoline by raising its price has been part and parcel of Big Green’s attachment to mpg standards — despite the fact that mileage reg’s do nothing to reduce driving and its vast negative consequences: not just traffic congestion but also poor health (sedentary living, car crashes, noise) and general unaffordability (car loan costs, upkeep expenses, costlier housing due to cars’ consuming urban and suburban land).

Amen. The failures propping up US carbon emissions are multiple. Not just Senator Joe Manchin, who torpedoed President Biden’s Build Back Better clean-energy legislation. Not just the Senate Republicans, any one of whom could have cast the critical 50th vote. And not just Big Carbon, whose

Amen. The failures propping up US carbon emissions are multiple. Not just Senator Joe Manchin, who torpedoed President Biden’s Build Back Better clean-energy legislation. Not just the Senate Republicans, any one of whom could have cast the critical 50th vote. And not just Big Carbon, whose

Owen’s article, which is well worth reading for its narrative power and climate relevance as well as its iconoclasm, was his latest exposition of Jevon’s Paradox, the phenomenon by which increases in energy efficiency lower the price of “energy services” and thus lead to more use, undercutting the efficiency gain. The antidote, of course, is to ensure the energy services — cooling, travel, lighting, and so forth — don’t plunge in price by raising the price of energy provision, as I pointed out a decade ago in a post in Grist,

Owen’s article, which is well worth reading for its narrative power and climate relevance as well as its iconoclasm, was his latest exposition of Jevon’s Paradox, the phenomenon by which increases in energy efficiency lower the price of “energy services” and thus lead to more use, undercutting the efficiency gain. The antidote, of course, is to ensure the energy services — cooling, travel, lighting, and so forth — don’t plunge in price by raising the price of energy provision, as I pointed out a decade ago in a post in Grist,