The New York City Council today held a hearing on a suite of bills to limit noise from helicopter flights over New York City. The bill most pertinent to carbon taxing is a resolution supporting a proposed NY State $400 “noise tax” on flights taking off or landing at the city’s heliports.

My testimony, presented below, situates the proposed noise tax in the context of social-damage costing, also known as externality pricing. Previous CTC posts in this vein have covered NYC’s forthcoming congestion pricing plan, a California growers’ program that taxes excess withdrawals of groundwater for farming, and Berkeley, CA’s soda tax.

Educator from the NYC harbor ecology group Billion Oyster Project, at the April 16 City Hall Park rally organized by Stop The Chop NY/NJ. To speaker’s left are Councilmembers Lincoln Restler and Amanda Farias, lead sponsors of Intro 70 and Intro 26. Author photo.

As can be seen from photographs of the rally prior to the council hearing, the anti-heli-noise outfit Stop The Chop NY/NJ takes a reformist position on helicopter flights. I’m more militant in both deed, having helped organize a human blockade of the West 30th Street (Hudson River) heliport last September and language, preferring the term “luxury fights” to Stop The Chop’s “nonessential flights.”

That said, I tip my hat to Stop The Chop for their scrappy advocacy that has raised the profile of helicopters’ aural and other assaults on New Yorkers’ quality of life. The bills in question would not have been written and advanced without their years of organizing.

Testimony of Charles Komanoff[1] supporting Council Bills banning nonessential helicopter flights using municipal properties, and Council Resolution 0085-2024 endorsing state legislation imposing a noise-annoyance surcharge on nonessential helicopter flights in New York City[2]. Submitted on April 16, 2024. (My statement has been lightly edited for clarity. Bracketed numbers denote endnotes.)

I emphatically support Council bills Intro 26 and Intro 70 banning nonessential helicopter flights from the two City-run heliports. In addition, as an economist specializing in environmental costing,[3] I’d like to single out for praise Council Resolution 0085-2024 endorsing state legislators Kirsten Gonzalez’s and Bobby Carroll’s bills S7216B and A7638B imposing a noise fee on nonessential helicopter flights.[4]

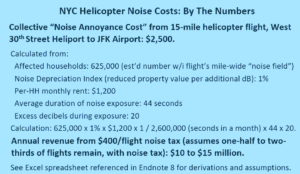

The Gonzalez-Carroll noise fee is $100 per occupied seat or $400 per flight, whichever amount is larger. Although these levies are less than the average helicopter flight’s apparent societal cost, they are a commendable starting point. The levies can be raised later on, as methodologies for quantifying helicopter noise costs mature — a process that will be aided by passing a related bill in the Council, Intro 27. The fees can also be lowered if quieter helicopters emerge — which the Gonzalez-Carroll bills will incentivize.

“Cost internalization,” as this kind of social-damage pricing is termed, is long overdue for helicopter noise. The luxury helicopter flights targeted by the Gonzalez and Carroll bills are completely discretionary. Anyone taking such a flight — whether to the Hamptons or JFK or for sightseeing — has money to spare, as revealed by their pricey transportation choice. Taxing helicopter noise is entirely consistent with economic justice. Moreover, these flights impose other costs beyond noise, such as carbon pollution and particulate-exhaust pollution, on everyone around or below.

Consider Blade’s JFK helicopter service from its Manhattan West 30th Street heliport — a flight covering about 15 miles. I’ve made a preliminary but serviceable calculation suggesting that one such flight lasting just seven minutes steals around $2,500 worth of peace and quiet from city residents.[5]

A more militant protest: Extinction Rebellion’s Sept 2023 human heliport blockade. See our post from that month, “Grounding Helicopter Luxury.” Photo: Christopher Ketcham.

The Gonzalez-Carroll noise fee amounts to a roughly 40 percent surcharge to Blade’s $250 standard ticket price to JFK, making it a worthy start. Assemblymember Carroll has been a legislative leader on externalities taxing, and it’s great to see Sen. Gonzalez also taking up the cause.

A noise fee raising the price of a commuter helicopter trip by 40 percent will cut usage, hence, the number of flights, by 30 to 50 percent,[6] as some would-be passengers opt out. (Yes, just like congestion pricing, except more draconian, and deservedly so, given luxury helicopters’ societal uselessness). That will not only bring a healthy measure of peace and quiet, it will generate $10 to $15 million per year[7] — revenue that New York City can use to expand and enforce noise-abatement rules citywide.

Noise isn’t the sole harm that commuter and tourist helicopters inflict on the millions of residents below. But it is the most egregious and insulting. Every member should vote Yes on the bills to ban nonessential helicopter flights from the two City-owned heliports. And please also vote for Council Resolution 0085-2024 to make clear to your Albany counterparts that New York City’s local elected officials support the Gonzalez-Carroll helicopter noise fee.

Endnotes.[8]

[1] Policy analyst and consulting economist at KEA, 11 Hanover Square, 21st floor, New York, NY 10005. Website www.komanoff.net.

[2] This document is available on line as https://www.komanoff.net/jet_skis/Komanoff_Testimony_City_Council_Helicopter_Noise_Costs.pdf.

[3] My work quantifying and supporting NYC congestion pricing is widely known; much of it is collected here. My body of research also includes Drowning in Noise: Noise Costs of Jet Skis in the United States, a monograph co-authored with Dr. Howard Shaw and published in 2000 by the Noise Pollution Clearinghouse.

[4] Assemblymember Bobby Carroll represents part of Brooklyn. State Senator Kristen Gonzalez represents parts of Brooklyn, Queens and Manhattan.

[5] Key assumptions in my calculation of a $2,500 collective noise cost per flight from W 30 St to JFK Blade include: 625,000 households in Manhattan, Brooklyn and Queens households lie within the helicopter noise field; excess noise of 20 dBA during the average 44 seconds of noise exposure for each flight; a “Noise Depreciation Index” — reduced property value per additional decibel during exposure — of 1%. Some parameters in the calculation are placeholder values, making the resulting $2,500 estimated per-flight collective noise cost preliminary and subject to change. See Excel spreadsheet referenced in final endnote.

[5] Key assumptions in my calculation of a $2,500 collective noise cost per flight from W 30 St to JFK Blade include: 625,000 households in Manhattan, Brooklyn and Queens households lie within the helicopter noise field; excess noise of 20 dBA during the average 44 seconds of noise exposure for each flight; a “Noise Depreciation Index” — reduced property value per additional decibel during exposure — of 1%. Some parameters in the calculation are placeholder values, making the resulting $2,500 estimated per-flight collective noise cost preliminary and subject to change. See Excel spreadsheet referenced in final endnote.

[6] The 30 percent reduction is associated with a price-elasticity of helicopter flights of negative 1, while the 50 percent reduction comes from a price-elasticity of negative 2. The respective calculations are: 1.4^(-1) ~ 0.7, and 1.4^(-2) ~ 0.5. (My high price-elasticity figures reflect the discretionary and luxury nature of helicopter travel.) See Excel spreadsheet referenced in final endnote.

[7] The number of helicopter flights per year that would be subject to the Gonzalez-Carroll noise tax appears to be between 50,000 and 60,000 per year. I have used the lower figure (50,000) in my calculations. Taking into account that the incorporation of the proposed tax into the price of helicopter flights would be expected to reduce the number of flights by 30 to 50 percent, and applying a per-flight noise fee of $400, the annual tax revenues, rounded, calculate to between $10 and $15 million per year (50k x $400 x 50% or 70%).

[8] An Excel spreadsheet (NYC_Helicopter_Flights_Externality_Costs.xls) with assumptions, calculations and citations supporting my preliminary $2,500 per-flight noise cost estimate, my tax revenue estimate of $10 to $15 million, and other figures in my testimony may be downloaded via this link: https://www.komanoff.net/jet_skis/NYC_Helicopter_Flights_Externality_Costs.xlsx.

“Diablo Canyon has not received the safety upgrades and maintenance it needs and we are dubious that nuclear is safe in any regard, let alone without these upgrades – it’s a huge problem,” said Hallie Templeton, legal director of Friends of the Earth, which was founded in 1969 to, among other things, oppose Diablo Canyon.

“Diablo Canyon has not received the safety upgrades and maintenance it needs and we are dubious that nuclear is safe in any regard, let alone without these upgrades – it’s a huge problem,” said Hallie Templeton, legal director of Friends of the Earth, which was founded in 1969 to, among other things, oppose Diablo Canyon.

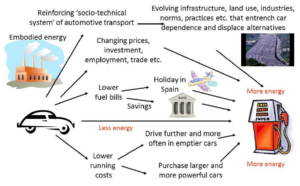

Owen’s thesis is that as a society becomes more energy efficient, it becomes downright inefficient not to use more. The pursuit of efficiency is smart for individuals and businesses but a dead end for energy and climate policy.

Owen’s thesis is that as a society becomes more energy efficient, it becomes downright inefficient not to use more. The pursuit of efficiency is smart for individuals and businesses but a dead end for energy and climate policy.

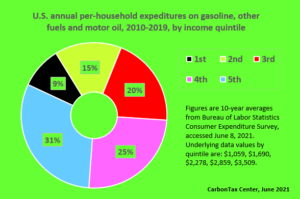

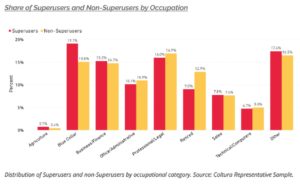

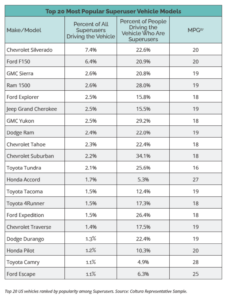

One-tenth of American motorists, we’ve just learned, consume more than a third of U.S. gasoline.

One-tenth of American motorists, we’ve just learned, consume more than a third of U.S. gasoline.

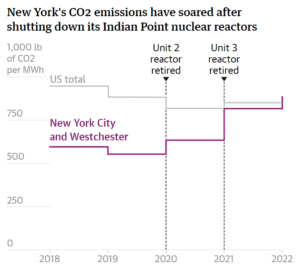

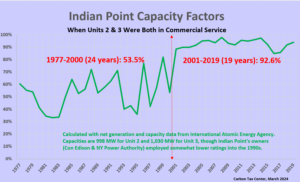

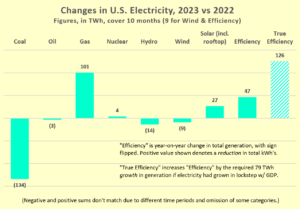

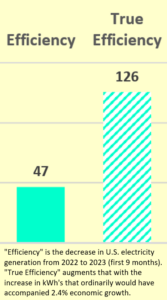

Here we examine the locus of the good news: the 8% drop in electricity generation in 2023 vs. 2022 that enabled the 2% drop in overall emissions despite rises in emissions from transportation and some other sectors.

Here we examine the locus of the good news: the 8% drop in electricity generation in 2023 vs. 2022 that enabled the 2% drop in overall emissions despite rises in emissions from transportation and some other sectors. But the efficiency story doesn’t end there. U.S. economic output wasn’t flat in 2023, it grew by 2.4% over 2022 (per preliminary figures

But the efficiency story doesn’t end there. U.S. economic output wasn’t flat in 2023, it grew by 2.4% over 2022 (per preliminary figures

Just as importantly, the growers receive a potent incentive to use available water supplies more efficiently. “Gone were the days of sprinklers that drenched fields indiscriminately,” Davenport writes. “To save money, many Pajaro farmers invested in precision irrigation technology to distribute carefully measured water exactly where it was needed.” (See text box.) Though the article doesn’t mention it, these investments by dozens of individual growers might not have materialized had not all growers been subject to the same incentives to conserve as well.

Just as importantly, the growers receive a potent incentive to use available water supplies more efficiently. “Gone were the days of sprinklers that drenched fields indiscriminately,” Davenport writes. “To save money, many Pajaro farmers invested in precision irrigation technology to distribute carefully measured water exactly where it was needed.” (See text box.) Though the article doesn’t mention it, these investments by dozens of individual growers might not have materialized had not all growers been subject to the same incentives to conserve as well. After reading Davenport’s article I reached out to hydrologist, climatologist and water sustainability expert Peter Gleick, whose latest book,

After reading Davenport’s article I reached out to hydrologist, climatologist and water sustainability expert Peter Gleick, whose latest book,

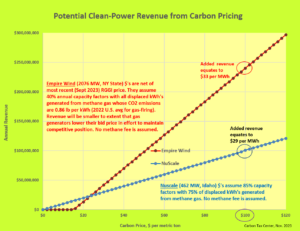

Suppose carbon emissions were taxed in every country. Would that entail colonizing of poor nations by the rich? It could, but only if the carbon-tax wealth — the revenue generated by the tax on carbon emissions — was siphoned off by the rich countries.

Suppose carbon emissions were taxed in every country. Would that entail colonizing of poor nations by the rich? It could, but only if the carbon-tax wealth — the revenue generated by the tax on carbon emissions — was siphoned off by the rich countries.